November 1, 2022

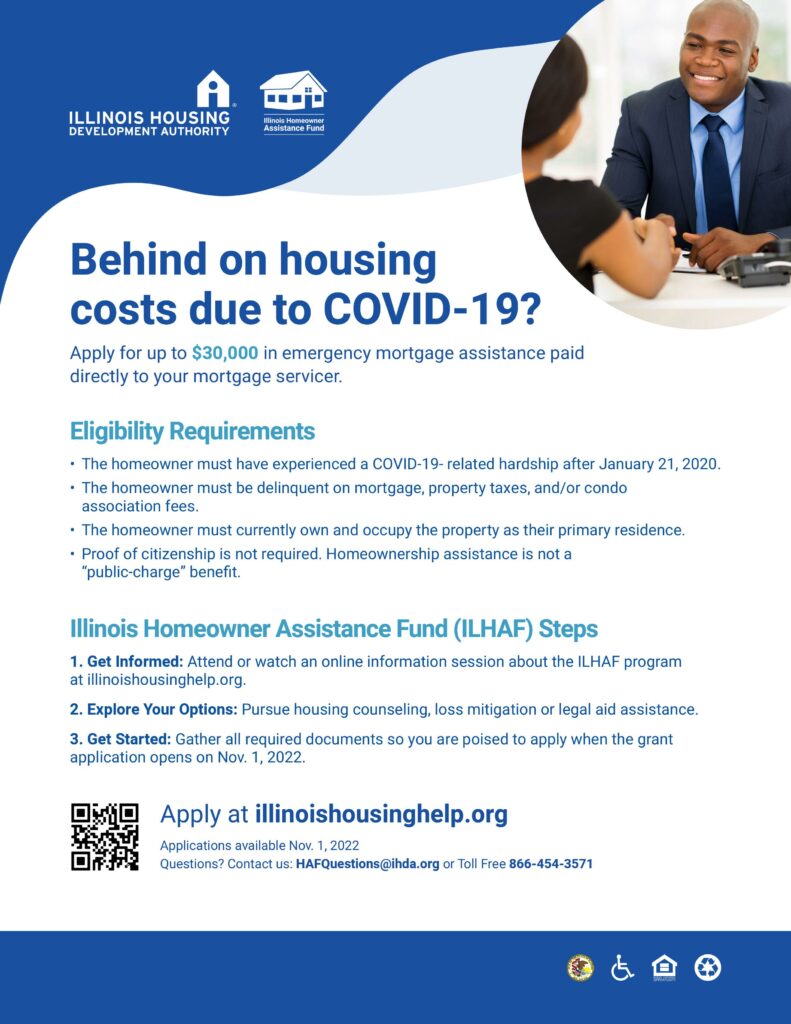

The American Rescue Plan Act passed by Congress in March of 2021 provided Illinois with funds to help homeowners at risk of default, foreclosure, and displacement as a result of the COVID-19 pandemic. Illinois homeowners experiencing financial hardship associated with the COVID-19 pandemic can apply for a housing assistance grant of up to $30,000. The program is administered by the Illinois Housing Development Authority (IHDA).

Assistance will be paid directly to the mortgagor’s loan servicer, taxing body, or other approved entity on behalf of the homeowner. Homeowners that have been disproportionately impacted by the pandemic will be prioritized in the distribution of funds.

The ILHAF program will begin accepting applications on Tuesday, Nov. 1, 2022, through Tues., Jan. 31, 2023. Starting today, interested homeowners can receive program announcements and updates by providing your contact information at the bottom of the page at www.illinoishousinghelp.org/ilhaf . The online application will be accessible at www.illinoishousinghelp.org.

The Program will accept applications from eligible, Illinois homeowners who meet the following criteria:

- Homeowner owns and occupies the property as their primary residence

- Property is in Illinois

- Properties that are eligible for ILHAF are dwellings located in Illinois that are one- to four-unit residential properties, specifically: Single-family/row home (attached or detached properties); condominium units; cooperatives; and manufactured/mobile homes.

- Homeowner has experienced a financial hardship as a result of the COVID-19 pandemic since January 21, 2020 and is seeking assistance with past due mortgage and housing-related expenses. This can include a qualified financial hardship that began before January 21, 2020, and continued after that date.

- Homeowner is at least 30 days past due on the mortgage payments and/or housing-related expenses for which they are requesting ILHAF assistance.

- Household income is equal to or less than 150% area median income (AMI). Click here to determine your income eligibility for ILHAF.

- Homeowner’s first mortgage is a conforming loan and meets the federal limits for the year in which the loan was taken.

- Homeowner cannot receive the same assistance for mortgage payment, mortgage reinstatement, property charges, property taxes, etc. from another federal, state, local, nonprofit, or tribal source.

Homeowners whose household income is equal to or less than 150% of the Area Median Income (“AMI”) and who have experienced a financial hardship directly or indirectly related to COVID-19 that began, continued, or worsened after January 21, 2020, are eligible to apply.

Also, federal guidelines require that mortgage assistance be used for homeowners who have an affordable and sustainable mortgage payment. Affordability is measured by comparing the monthly amount paid to the mortgage servicer and dividing it by the total gross monthly household income. If the result is below 42%, the mortgage is considered affordable, if the result is greater than 42%, the mortgage is deemed to be not affordable.

The ILHAF will provide homeowners who were affected by COVID-19 with several types of support:

- financial support to address delinquent housing payments, including mortgage payments, property taxes, homeowner association/condo/coop fees, manufactured home loans and if applicable, associated monthly lot rents;

- access to a Call Center and case managers who can help you find out about any mortgage relief you may be entitled to and how it will affect your future housing payments; and

- referrals to professional housing counselors or legal service providers who are experts in this field.

All assistance is free of charge. In all cases, the goal of ILHAF is to help as many Illinoisans as possible stay in their homes.

Homeowners who do not have a mortgage or are current on their mortgage payments but are behind on their property taxes and/or homeowner/condo/coop association fees may apply for assistance.

In order to apply for property tax assistance, the property tax payment must be due prior to the date of application submission. Only property taxes that are delinquent for tax years 2019, 2020 and 2021 are eligible for assistance. New for ILHAF 2.0, earlir delinquencies from tax year 2018 and earlier will no longer make your application ineligible for property tax assistance. You can now also receive assistance for any property taxes from tax years 2019 through 2021 if they have been sold and are in redemption.

In order to apply for the homeowner/condo/coop association assistance, the fees and dues for the association must be delinquent at least 30 days prior to the date of your application.

If your mortgage is current, however, your application will not be eligible for assistance with past due second/third mortgage(s), property insurance statement, property flood insurance or manufactured/mobile home lot rent.

Homeowners can complete their online ILHAF application by visiting www.illinoishousinghelp.org and completing the pre-eligibility questionnaire, creating an ILHAF account, and providing the required information and documents. Applicants are encouraged to review the eligibility criteria and list of required documents available at www.illinoishousinghelp.org prior to starting their application.

Applicants are strongly encouraged to make the following preparations before they apply for ILHAF:

- Get Informed: Homeowners are strongly encouraged to review all ILHAF materials to learn and educate themselves about the program.

- Explore Your Options: Homeowners are required to contact their mortgage servicer or a HUD-certified housing counseling agency to discuss loss mitigation options before they are eligible to receive assistance. Schedule a meeting with a HUD-approved housing counseling agency as soon as possible.

- Get Started: review the Acceptable Documentation list and be prepared with all required documents when the application opens in Nov. 2022.

ILHAF Information Sessions

Homeowners are strongly encouraged to attend a webinar hosted by IHDA in advance of the application portal opening. These sessions will provide a roadmap for you to follow to make the application process more efficient. Topics will include:

- Description of loss mitigation

- Mortgage basics

- The foreclosure process

- The ILHAF application process and program eligibility

- Other free resources available to you, including housing counseling and legal aid

Webinars will be offered in English and Spanish. Check this page for links and instructions to attend sessions at the dates below:

English:

Spanish:

If I don’t have access to a computer can I still apply?

Yes. We have housing assistance agency partners who can assist you with your application. All services are free of charge. Partners can be found at https://www.illinoishousinghelp.org/ilhaf#map.